The Bill of Sale For Car in Texas is a crucial legal document that serves as proof of the transaction between the seller and the buyer. This document outlines the terms of the sale, providing essential details about the vehicle and the parties involved. A well-drafted Bill of Sale not only confirms the transfer of ownership but also protects the rights of both parties by documenting the agreement. The significance of a Bill of Sale lies in its ability to serve as a legal record, offering evidence in case of disputes and ensuring that the transaction is conducted transparently.

In vehicle transactions, having a legally binding document like a Car Bill of Sale in Texas is vital. It provides protection to both the buyer and seller, ensuring that all necessary information is recorded and agreed upon. For buyers, this document can help verify that the vehicle is not stolen, has a clear title, and accurately represents the condition disclosed by the seller. For sellers, it provides proof that they have transferred ownership, which can be critical if any issues arise post-sale. Whether you are looking for a Texas Bill of Sale for Car or a Car Bill of Sale Texas PDF, understanding the importance of this document is essential for a smooth and lawful vehicle transaction.

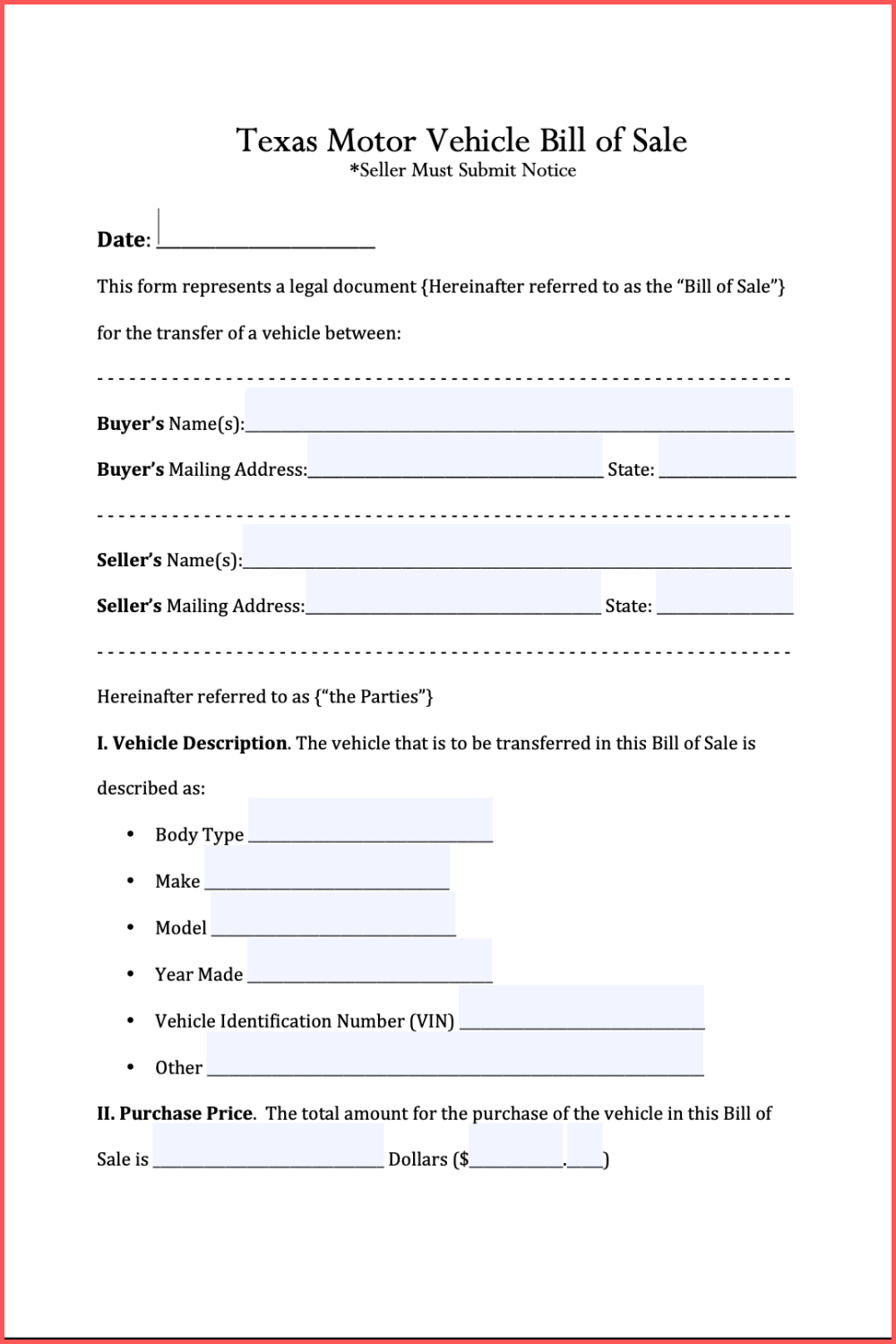

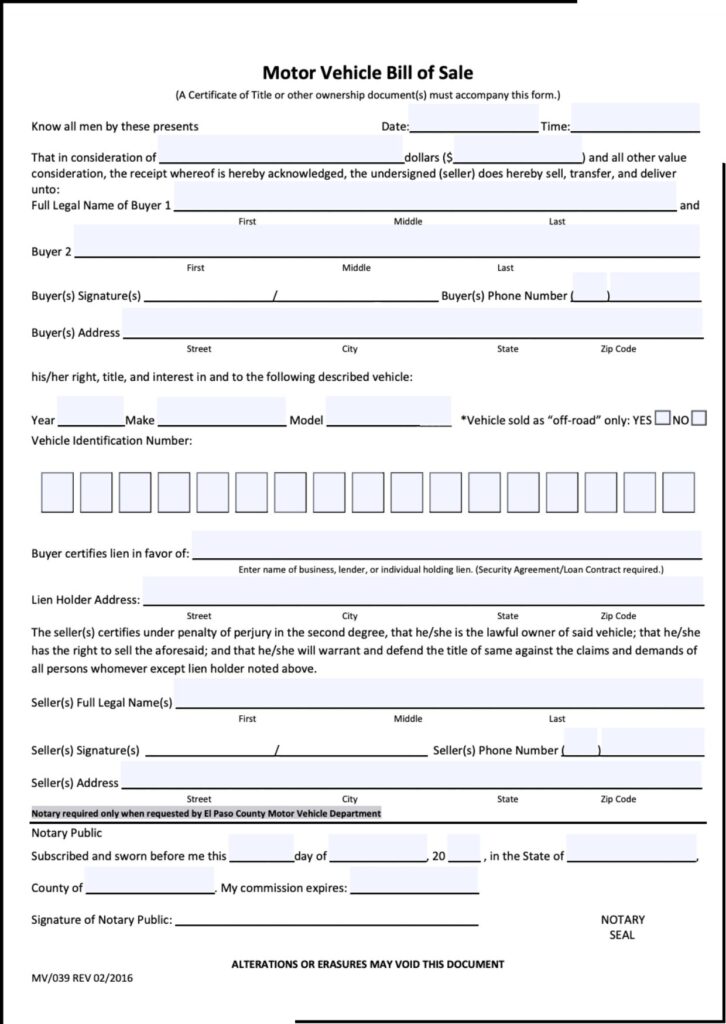

Free Bill of Sale Template For a Car in Texas

A Free Bill of Sale Template for a Car in Texas is a valuable document that records the legal transfer of a vehicle from a seller to a buyer. This template helps both parties by outlining essential details like the vehicle’s make, model, VIN, and sale price, ensuring a smooth transaction. Key benefits include:

- Proof of Ownership Transfer: Ensures legal protection for both buyer and seller.

- Tax and Registration Requirements: Helps meet Texas DMV requirements.

- Avoid Future Disputes: Clearly outlines terms of sale, reducing the risk of misunderstandings.

- Easy to Use: Simple, free, and customizable for your specific transaction.

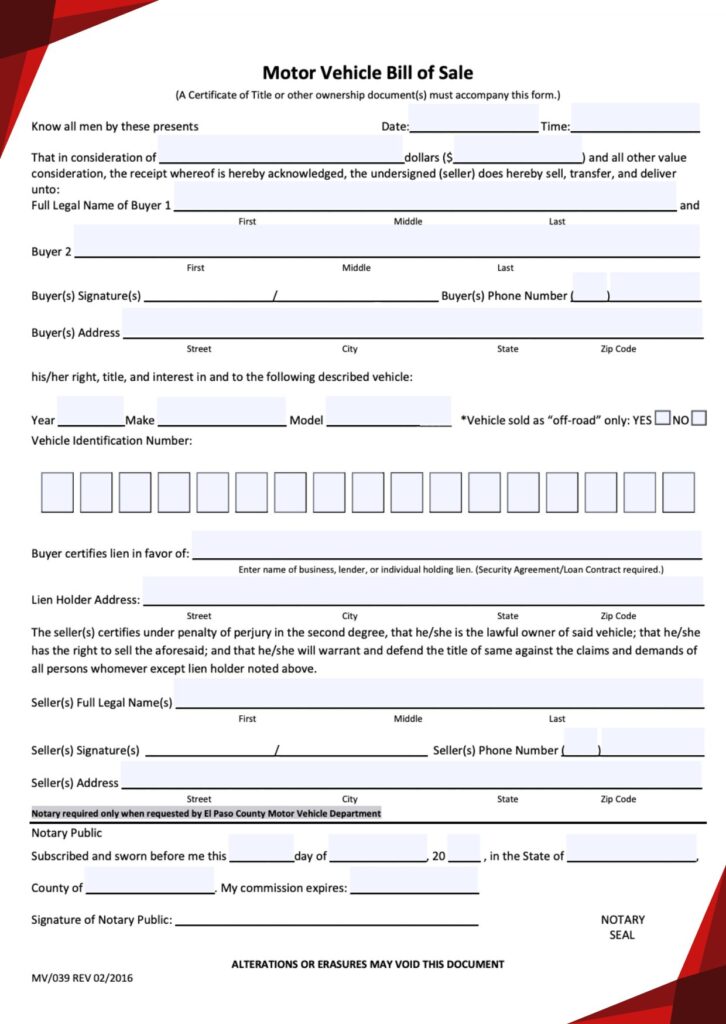

Texas Car Bill of Sale Form

A Texas Car Bill of Sale Form is a legal document that records the transfer of ownership of a vehicle from the seller to the buyer. It serves as proof of the transaction, protecting both parties in case of future disputes. While not always required by law for vehicle sales in Texas, having a Bill of Sale can be highly beneficial.

Benefits:

- Provides legal proof of ownership transfer

- Contains essential vehicle details (VIN, make, model)

- Protects both buyer and seller from potential liabilities

- Facilitates registration and title transfer

- Can help prevent fraud or disputes over the vehicle sale.

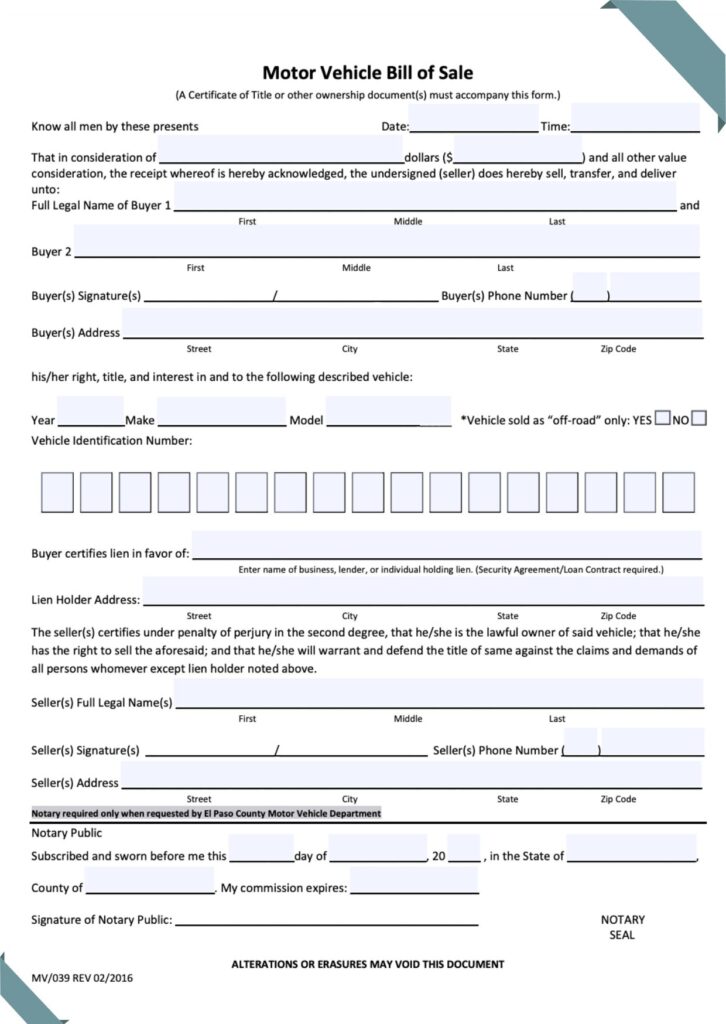

Sample Bill of Sale For Car in Texas PDF

Used Car Bill of Sale Texas

A Used Car Bill of Sale in Texas is a legal document that records the transfer of ownership of a used vehicle between a seller and buyer. This essential document outlines critical details such as the vehicle’s make, model, VIN (Vehicle Identification Number), sale price, and both parties’ information.

Benefits include:

- Proof of Ownership: Establishes the buyer as the new legal owner.

- Legal Protection: Safeguards both parties from future disputes or claims.

- Tax Documentation: Used to report and pay necessary taxes.

- Official Record: Helps during registration and title transfer at the DMV.

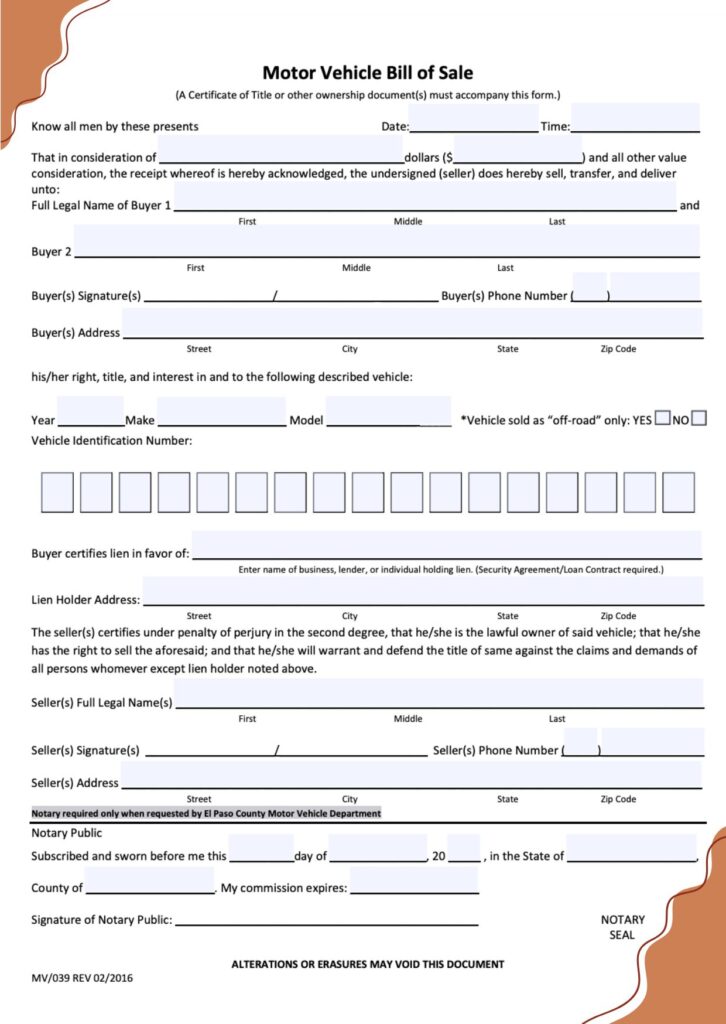

In Texas, a Bill of Sale alone does not legally transfer vehicle ownership — the title transfer must be completed through the Texas Department of Motor Vehicles (TxDMV).

Why this matters:

Many people think signing a Bill of Sale makes the buyer the new owner, but in Texas, the signed title is what legally transfers ownership. The Bill of Sale is only a supporting document — useful for:

-

Proving the sale date and price

-

Protecting both buyer and seller in case of disputes

-

Helping with tax and registration records

Pro Tip: Always complete and sign Form 130-U (Application for Texas Title and/or Registration) along with the Bill of Sale when buying or selling a car in Texas.

How to Use a Printable Bill of Sale in Texas?

Using a printable Bill of Sale in Texas is a simple and efficient process. Follow these steps to download, fill out, and complete the Bill of Sale:

- Open the PDF Form

- Click on the PDF link provided on our website. This will open the printable Bill of Sale form in your browser.

- Fill in the Required Information

- Once the PDF form opens, you can fill in the required fields directly in the document. Enter the following information:

- Description of the item: Include details like the make, model, and year of the vehicle.

- Sale price: Specify the agreed-upon amount for the transaction.

- Buyer and seller information: Provide names, addresses, and contact details for both parties.

- Once the PDF form opens, you can fill in the required fields directly in the document. Enter the following information:

- Save the Completed Form

- After filling in all the necessary information, save the completed form to your device.

- Look for the “Save” or “Download” option in your PDF viewer to save the document.

- Add Signatures

- Both the buyer and seller need to sign the Bill of Sale to make it legally binding.

- You can print the document and sign it by hand or use an electronic signature.

- For electronic signatures, you can use the free online service provided by DocuSign:

- Click (https://www.docusign.com/esignature/free-electronic-signature) to access the free e-signature tool.

- Follow the on-screen instructions to upload your document and add signatures for both parties.

- Print Copies for Both Parties

- Once the form is signed, print additional copies for both the buyer and seller to keep as records.

- Keep a Copy for Legal Protection

- While Texas law may not always require a Bill of Sale, it’s recommended that both parties retain a copy as proof of the transaction.

- This document can help protect against potential disputes in the future by clearly outlining the terms of the sale.

Using a Bill of Sale in Texas is a straightforward yet crucial step in any transaction involving personal property. It not only serves as a formal receipt but also protects the rights of both the buyer and seller. By utilizing our free printable templates, you can ensure that all necessary information is documented clearly, minimizing the potential for disputes in the future.

Whether you’re buying or selling a vehicle, boat, or any other personal item, having a Bill of Sale is a smart practice. Always remember to keep copies of the signed document for your records, as it provides valuable proof of ownership transfer. Don’t hesitate to use the resources available to you for a seamless transaction experience!

Texas Department of Motor Vehicles (DMV) Reference

When buying or selling a vehicle in Texas, it is essential to follow the proper legal procedures to ensure the ownership transfer is complete and recognized by the state. The Texas Department of Motor Vehicles (DMV) oversees these transactions and ensures that both buyers and sellers fulfill their obligations. The following information outlines key steps for both parties after completing the sale of a vehicle.

For the Buyer: Title Transfer and Fees

After purchasing a vehicle in Texas, the buyer is legally required to file for a title transfer with the Texas DMV. This ensures that the new owner is officially recognized, and the state’s records reflect the ownership change.

- File the Title Transfer: The buyer must visit their local Texas DMV office or use the Texas DMV’s online portal to submit the application for a title transfer within 30 days of the purchase. Failing to do so could result in penalties or late fees.

- Required Documents: The buyer will need to provide the signed title, a completed application for the Texas title, and the Bill of Sale. In some cases, additional documentation, such as proof of insurance or a lien release, may be required.

- Pay Applicable Fees: The buyer is responsible for paying the title transfer fee, which varies based on the county. Other fees, including sales tax (6.25% of the vehicle’s sale price) and registration fees, may also apply.

For the Seller: Keeping a Record

Once the vehicle has been sold, the seller should ensure they retain a copy of the Bill of Sale for their personal records. This document serves as proof that the vehicle was sold and helps protect the seller from any liabilities or issues that may arise after the sale.

- Retain a Copy: The seller should keep a copy of the Bill of Sale for at least several years, as it contains essential details such as the buyer’s information, the sale date, and the final sale price.

- Release of Liability: To further protect themselves, the seller can submit a Vehicle Transfer Notification to the Texas DMV. This notifies the state that they are no longer the owner of the vehicle and shifts any future responsibilities or legal matters to the new owner.

Both the buyer and seller must follow these steps to ensure a smooth and legal transfer of ownership through the Texas DMV.

FAQ

What is a Bill of Sale for a car in Texas?

A Bill of Sale for a car in Texas is a legal document that records the details of a vehicle sale between a buyer and a seller. While it is not required by Texas law to complete the sale, it serves as important proof that the transaction occurred. The document typically includes key information such as the identities of both parties, a description of the vehicle, the sale price, and the date of the sale.

The Bill of Sale is useful for:

- Providing a record of the sale for both the buyer and seller.

- Helping the buyer with title transfer at the Texas Department of Motor Vehicles (DMV).

- Protecting the seller from any liabilities after the sale by offering proof that ownership was transferred.

Additionally, it often contains an Odometer Disclosure Statement to confirm the vehicle’s mileage at the time of sale, which is required by law in Texas. Even though it’s not mandatory, many buyers and sellers choose to use a Bill of Sale to document their transaction and protect their interests.

What should be included in a Bill of Sale for a car in Texas?

A Texas Bill of Sale for a car should include:

- The full legal names and addresses of both the buyer and seller.

- A detailed description of the vehicle (make, model, year, VIN).

- The sale price and the method of payment.

- Odometer reading at the time of sale.

- Date of sale.

- Any relevant conditions or disclosures, such as “as is” or existing liens.

- Signatures of both parties.

How do I file for a title transfer with the Texas DMV?

The buyer must submit a completed title transfer application to the Texas DMV within 30 days of purchasing the vehicle. This can be done in person at a DMV office or online. The buyer will need the signed title, the Bill of Sale, and payment for the applicable fees, including the title transfer fee, sales tax, and any registration fees.

What fees are associated with transferring a title in Texas?

When transferring the title of a vehicle, the buyer is responsible for paying:

- Title transfer fee (varies by county, usually between $28-$33).

- Sales tax (6.25% of the vehicle’s sale price).

- Additional fees for vehicle registration, inspection, and other county-specific charges.

What is the Odometer Disclosure Statement?

The Odometer Disclosure Statement is a legally required document that provides an accurate record of a vehicle’s mileage at the time of its sale or transfer of ownership. In Texas, as well as in most states, the federal Truth in Mileage Act mandates this disclosure to prevent fraud and ensure that the buyer is aware of the vehicle’s actual mileage. This protects both the buyer and the seller by preventing the manipulation or “rolling back” of the odometer.

Key Points of the Odometer Disclosure Statement:

- Required Information:

- The exact mileage on the odometer at the time of sale.

- A declaration stating whether the mileage displayed is accurate, inaccurate, or if the odometer has exceeded its mechanical limits (for vehicles over 100,000 miles).

- Who Must Provide It?

- The seller is responsible for completing the Odometer Disclosure Statement and providing it to the buyer as part of the vehicle sale process.

- Where Is It Included?

- In Texas, the Odometer Disclosure Statement is typically included on the back of the vehicle title. If it is not part of the title, a separate statement or form can be used.

- Why Is It Important?

- It ensures transparency in the sale by confirming the vehicle’s mileage.

- Helps the buyer make an informed decision about the vehicle’s condition and value.

- Prevents odometer fraud, which can lead to financial loss or legal issues.

Failure to provide an accurate Odometer Disclosure Statement can result in penalties or legal consequences for the seller, as it is a critical part of any vehicle transaction in Texas.

Hi, I’m William Bennett, an Automotive Executive based in Houston, Texas. With years of experience in the automotive industry, I created Bill of Sale Texas to offer Texans a straightforward resource for managing bill of sale documents. My goal is to help make the process of buying and selling vehicles in Texas as smooth and informed as possible.

![Bill of Sale Texas For Car, Vehicle [Edit & Printable] PDF](https://billofsaletexas.com/wordpress/wp-content/uploads/2024/11/Bill-of-Sale-texas-1-160x45.png)