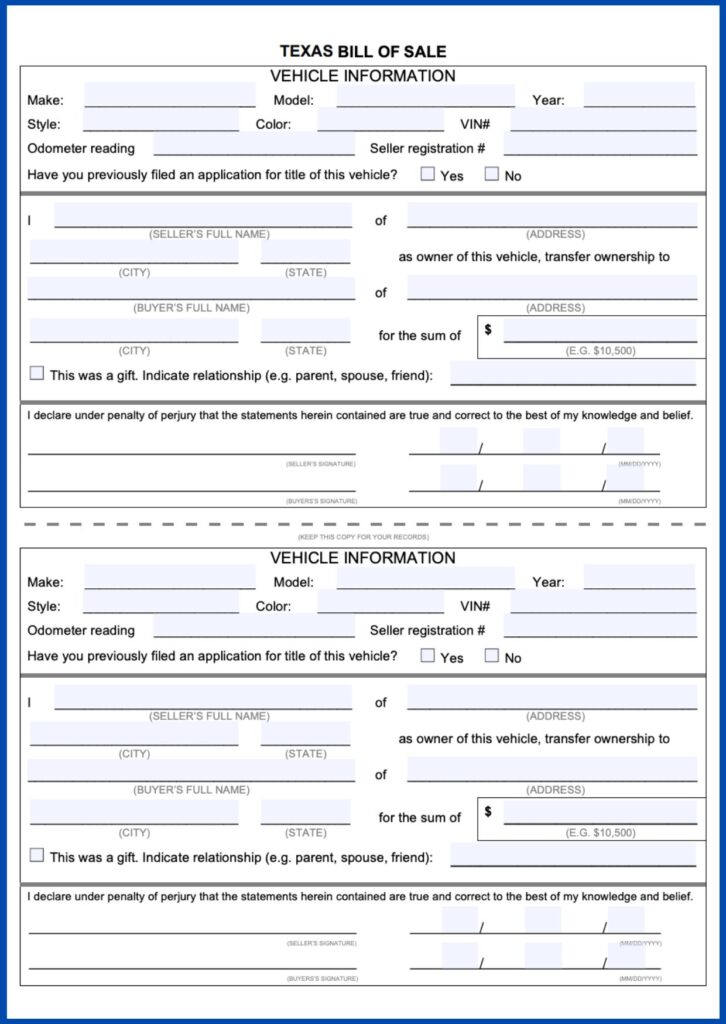

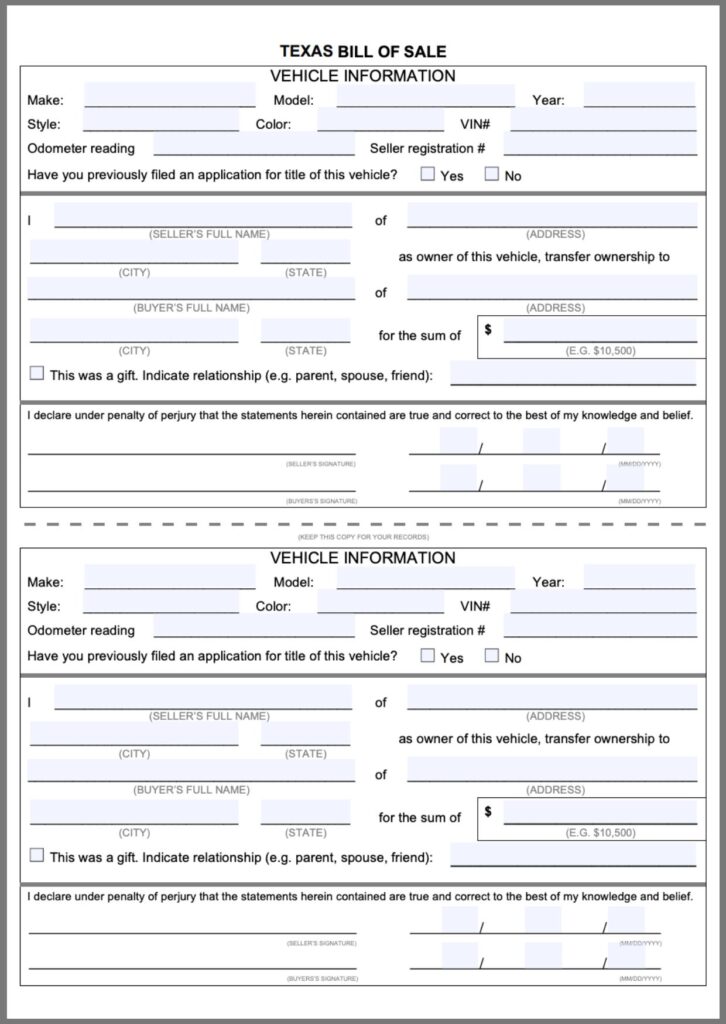

A Simple Bill of Sale in Texas is a legal document that outlines the transfer of ownership of an item from a seller to a buyer. This document serves as proof of the transaction and includes essential details such as the description of the item, purchase price, and the names of both parties involved. In Texas, having a bill of sale is crucial, particularly for significant purchases like vehicles, as it provides a clear record of the sale and protects both the buyer and seller in the event of any disputes.

For instance, a Simple Bill of Sale For a Car in Texas details the specifics of the vehicle being sold, including its make, model, year, and Vehicle Identification Number (VIN). An Example of a Simple “as is” Car Bill of Sale in Texas would state that the buyer accepts the vehicle in its current condition, which can be vital in avoiding future claims about the car’s condition. Additionally, a Simple Auto Bill of Sale in Texas can help ensure that all necessary information is documented, making the process smoother for both parties and providing legal protection during the transaction.

Free Simple Bill of Sale Texas Templates

A Bill of Sale is a vital document that serves as proof of a transaction between a buyer and a seller. In Texas, utilizing a free simple Bill of Sale template can streamline the process of transferring ownership for various items, such as vehicles, furniture, or electronics. Key points to consider include:

- Legal Protection: Provides evidence of the sale and protects both parties.

- Customizable: Templates can be tailored to fit specific transactions.

- Easy to Use: Simplifies the process with clear, straightforward language.

- State Compliance: Ensures adherence to Texas state laws and regulations.

Simple Bill of Sale Texas PDF

Purchase Price

The purchase price is a critical component of a bill of sale, as it specifies the total amount agreed upon for the item being sold. Clearly stating the purchase price helps to prevent misunderstandings or disputes between the buyer and seller. This section provides transparency in the transaction and ensures both parties are aware of their financial obligations.

Key Points to Include in the Purchase Price Section:

- Total Sale Price:

- Clearly state the total sale price of the item. This is the final amount that the buyer agrees to pay the seller.

- Example: “The total sale price of the item is $2,500.”

- It is essential to ensure this figure is accurate and agreed upon by both parties to avoid any future disputes.

- Payment Method:

- Specify the payment method being used for the transaction. Common methods include:

- Cash: If the buyer is paying in cash, it’s important to indicate this to confirm immediate payment.

- Check: If payment is made via check, note whether it is a personal check or a certified check. Additionally, mention any conditions, such as the check needing to clear before the item is transferred.

- Money Order: For buyers who prefer using a money order, specify this method to ensure clarity in the transaction.

- Example: “The payment will be made in cash, by personal check, or by money order, as agreed upon by both parties.”

- Consider including a clause that requires a receipt to be issued for cash payments or a statement indicating that the item will only be transferred once payment has been confirmed.

- Specify the payment method being used for the transaction. Common methods include:

- Additional Considerations:

- If there are any deposits or installment payments, outline these terms clearly, including amounts and due dates.

- Mention any applicable taxes or fees that may be included in the purchase price, such as sales tax or transfer fees.

- Clarify whether the sale price includes any additional items or services, such as warranties or delivery fees.

By detailing the purchase price in the bill of sale, both the buyer and seller can have a clear understanding of the financial terms of their transaction, fostering trust and reducing the potential for misunderstandings.

Warranty Information

In any transaction involving the sale of goods, warranty information is crucial for defining the level of protection provided to the buyer regarding the condition and functionality of the item. Including a warranty section in a bill of sale clarifies the expectations and responsibilities of both the seller and the buyer.

Key Points to Include in the Warranty Information Section:

- As-Is Clause:

- The as-is clause is a critical component of the warranty information, indicating that the item is sold in its current condition, with all its faults and imperfections. This means the seller is not responsible for any repairs or replacements after the sale is completed.

- Example: “The buyer acknowledges that the item is sold ‘as-is’ and that the seller makes no warranties or representations regarding the condition, functionality, or suitability of the item for any purpose.”

- This statement protects the seller from liability for issues that may arise after the sale and places the responsibility for inspection and evaluation on the buyer.

- Explicit Warranties (if applicable):

- If the seller offers any explicit warranties, such as a limited warranty or guarantee, these should be clearly stated in this section.

- Example: “The seller warrants that the item is free from liens and encumbrances and is the rightful owner. Any warranty beyond this is specifically outlined as follows: [insert specific warranty terms].”

- Clearly defining any warranties helps to establish trust and gives the buyer a better understanding of their rights regarding the item.

- Limitations on Liability:

- If applicable, include a statement regarding the limitations of liability for any defects or damages that may occur after the sale. This further clarifies the seller’s position.

- Example: “The seller shall not be liable for any incidental or consequential damages resulting from the use of the item after the sale.”

- Buyer’s Responsibility:

- Remind the buyer of their responsibility to inspect the item before purchase. Encouraging the buyer to conduct due diligence can help mitigate future disputes.

- Example: “The buyer is encouraged to inspect the item thoroughly prior to purchase and acknowledges that they are satisfied with its condition.”

By incorporating a warranty information section with a clear as-is clause in the bill of sale, both parties can establish a mutual understanding of the terms of the sale. This not only protects the seller from future claims but also ensures the buyer is aware of the condition of the item they are purchasing.

FAQ

What is a bill of sale?

A bill of sale is a legal document that serves as proof of a transaction between a buyer and a seller. It formally records the transfer of ownership of personal property from one party to another. Here are the key aspects of a bill of sale:

Key Features of a Bill of Sale

- Identification of Parties:

- The document typically includes the full names and addresses of both the buyer and the seller, clearly identifying the individuals involved in the transaction.

- Description of the Item:

- A detailed description of the item being sold is included, which may encompass information such as:

- Type of item (e.g., vehicle, furniture, equipment)

- Make, model, and year (for vehicles)

- Serial or identification number (if applicable)

- Condition of the item (new, used, etc.)

- A detailed description of the item being sold is included, which may encompass information such as:

- Purchase Price:

- The bill of sale specifies the total sale price agreed upon by both parties, along with the payment method (e.g., cash, check, money order).

- Warranties and Disclaimers:

- It may include warranty information, such as whether the item is sold “as-is” (meaning the seller does not guarantee its condition), or any explicit warranties offered by the seller.

- Signatures:

- The document requires the signatures of both the buyer and the seller, indicating their agreement to the terms outlined in the bill of sale.

- Date of Sale:

- The date of the transaction is typically recorded, marking when the ownership transfer takes place.

Purpose of a Bill of Sale

- Proof of Transaction: A bill of sale serves as evidence that a sale has occurred, which can be important for legal and tax purposes.

- Protection for Both Parties: It protects the seller by providing a record of the sale and the condition of the item at the time of the sale, while also protecting the buyer by documenting the terms and conditions agreed upon.

- Facilitating Ownership Transfer: For certain items, such as vehicles or boats, a bill of sale may be required for registration or title transfer.

In summary, a bill of sale is a vital document that helps ensure clarity, transparency, and legal protection for both buyers and sellers during a transaction.

What information should be included in a bill of sale?

A bill of sale should contain specific information to ensure it is clear, comprehensive, and legally binding. Here are the key elements that should be included:

Information to Include in a Bill of Sale

- Date of Sale:

- The date when the transaction takes place.

- Names and Addresses:

- Full legal names and addresses of both the buyer and the seller. This identifies the parties involved in the transaction.

- Description of the Item:

- A detailed description of the item being sold, which may include:

- Type of item (e.g., vehicle, furniture, equipment)

- Make, model, and year (for vehicles)

- Color, size, and any distinguishing features

- Serial or identification number (if applicable)

- Condition of the item (new, used, etc.)

- A detailed description of the item being sold, which may include:

- Purchase Price:

- The total sale price agreed upon for the item, clearly stated to avoid misunderstandings.

- Payment Method:

- The method of payment being used (e.g., cash, check, money order), along with any relevant details about the payment (e.g., check number).

- Warranties and Disclaimers:

- Any warranties provided by the seller or a statement indicating that the item is sold “as-is,” without warranties unless explicitly stated.

- Signatures:

- The signatures of both the buyer and the seller, along with the date of signing, indicating their agreement to the terms outlined in the bill of sale.

- Additional Terms (if applicable):

- Any additional terms or conditions related to the sale, such as:

- Delivery arrangements

- Return policy

- Inspection rights for the buyer

- Any additional terms or conditions related to the sale, such as:

- Witness Signatures (optional):

- In some cases, having a witness sign the bill of sale can provide additional legitimacy to the document.

Including these elements in a bill of sale helps to ensure clarity and protect the rights of both the buyer and the seller. A well-drafted bill of sale serves as a crucial record of the transaction and can help prevent disputes in the future.

Do I need a notary public to sign the bill of sale?

A bill of sale does not need to be notarized in Texas unless it is required for specific transactions, such as vehicles. However, having it notarized can provide an extra layer of authenticity and protection for both parties.

Can I create my own bill of sale?

Yes, you can create your own bill of sale. It’s a straightforward process, and doing so allows you to tailor the document to meet the specific details of your transaction. Here are some key points to consider when creating your own bill of sale:

Steps to Create Your Own Bill of Sale

- Choose a Template:

- You can find various templates online that provide a basic structure for a bill of sale. Choose one that suits your needs and can be easily customized.

- Include Necessary Information:

- Make sure to include all essential elements such as:

- Date of sale

- Names and addresses of both the buyer and seller

- Detailed description of the item being sold

- Purchase price

- Payment method

- Warranty information (if any)

- Signatures of both parties

- Make sure to include all essential elements such as:

- Be Clear and Concise:

- Write in clear and simple language to avoid misunderstandings. Ensure that each section of the bill of sale is easy to read and comprehend.

- Review Legal Requirements:

- Check if there are any specific legal requirements for a bill of sale in your state or for the type of item being sold. For example, some transactions, like vehicles, may require additional documentation.

- Sign the Document:

- Once completed, both the buyer and seller should sign the bill of sale to indicate their agreement to the terms.

- Keep Copies:

- Both parties should keep a copy of the signed bill of sale for their records. This serves as proof of the transaction.

Benefits of Creating Your Own Bill of Sale

- Customization: You can tailor the document to fit your specific transaction and include any additional terms that are important to you.

- Cost-Effective: Creating your own bill of sale can save you the cost of hiring a lawyer or using a service.

- Control: You have full control over the content and format of the document, ensuring it meets your needs.

Creating your own bill of sale is a feasible and effective way to document a transaction. By including all necessary information and ensuring clarity, you can create a legally binding document that protects both parties involved in the sale.

Hi, I’m William Bennett, an Automotive Executive based in Houston, Texas. With years of experience in the automotive industry, I created Bill of Sale Texas to offer Texans a straightforward resource for managing bill of sale documents. My goal is to help make the process of buying and selling vehicles in Texas as smooth and informed as possible.

![Bill of Sale Texas For Car, Vehicle [Edit & Printable] PDF](https://billofsaletexas.com/wordpress/wp-content/uploads/2024/11/Bill-of-Sale-texas-1-160x45.png)