A Vehicle Bill of Sale Texas is a crucial document that serves as a written record of the transfer of ownership of a vehicle from one party to another. This document outlines essential details regarding the vehicle and the parties involved in the transaction, providing clarity and protection for both the seller and the buyer. The legal importance of the document in Texas cannot be overstated, as it acts as proof of the sale and is often required when registering the vehicle with the Texas Department of Motor Vehicles.

Having a Texas Bill of Sale for Vehicle is not only a best practice but a necessary step in ensuring a smooth transfer of ownership. It helps to establish the date of sale and the purchase price, and it can be crucial in resolving any disputes that may arise after the transaction. The Bill of Sale Vehicle Texas also serves as a safeguard against future liabilities, making it an indispensable part of the vehicle sale process. For convenience, many people choose to use a Texas Vehicle Bill of Sale PDF or a Texas Vehicle Bill of Sale Template to create their documents efficiently. Ultimately, this document is essential for the legal and seamless transfer of ownership in the State of Texas Vehicle Bill of Sale process.

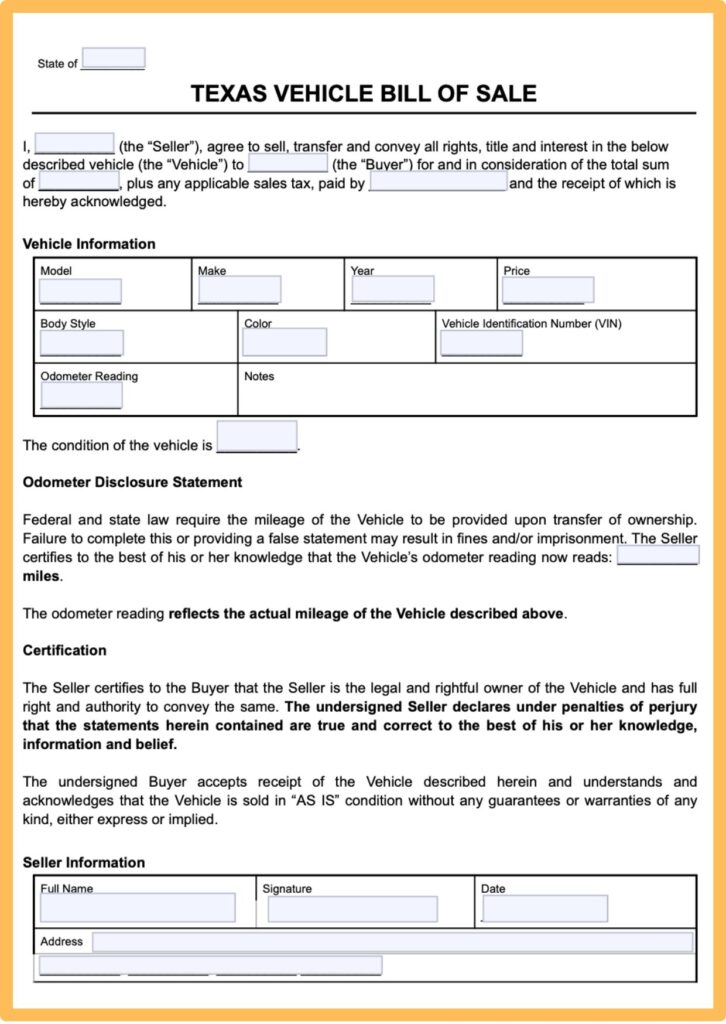

Free Vehicle Bill of Sale Texas Templates

A Free Vehicle Bill of Sale template in Texas is an essential document for anyone buying or selling a vehicle in the state. This template serves as a legal record of the transaction, ensuring both parties have a clear understanding of the sale terms.

Benefits of using a Free Vehicle Bill of Sale Template:

- Legal Protection: Provides proof of ownership transfer and protects both buyer and seller.

- Clarity: Clearly outlines the terms of the sale, including price, vehicle condition, and any warranties.

- Convenience: Easily accessible and customizable to fit individual needs.

- Record Keeping: Helps maintain accurate records for future reference or legal purposes.

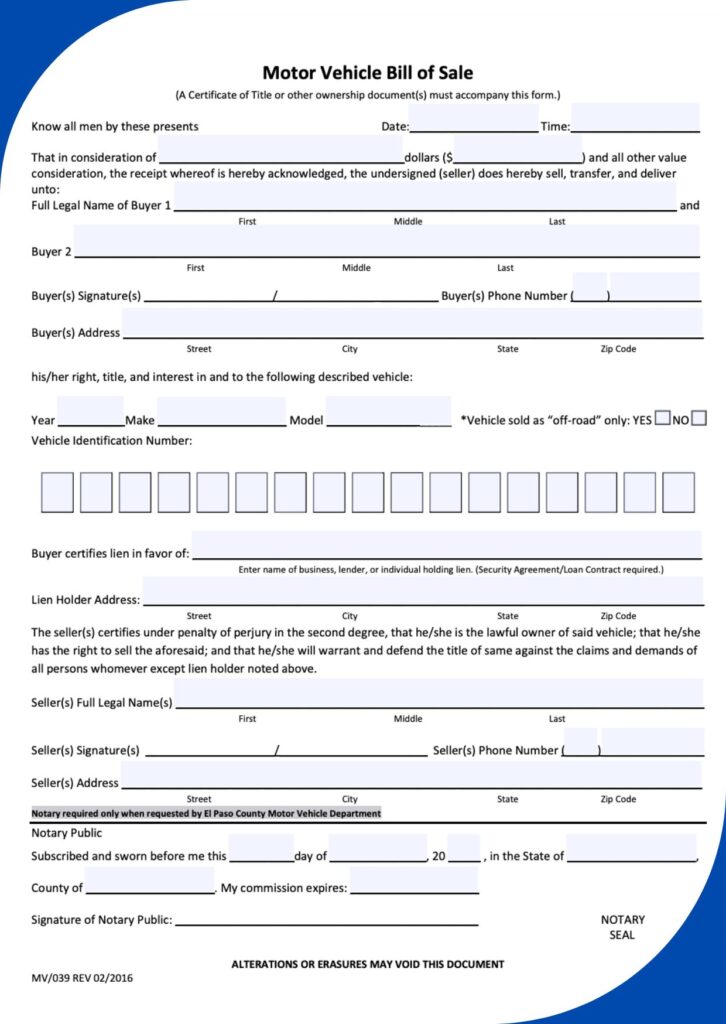

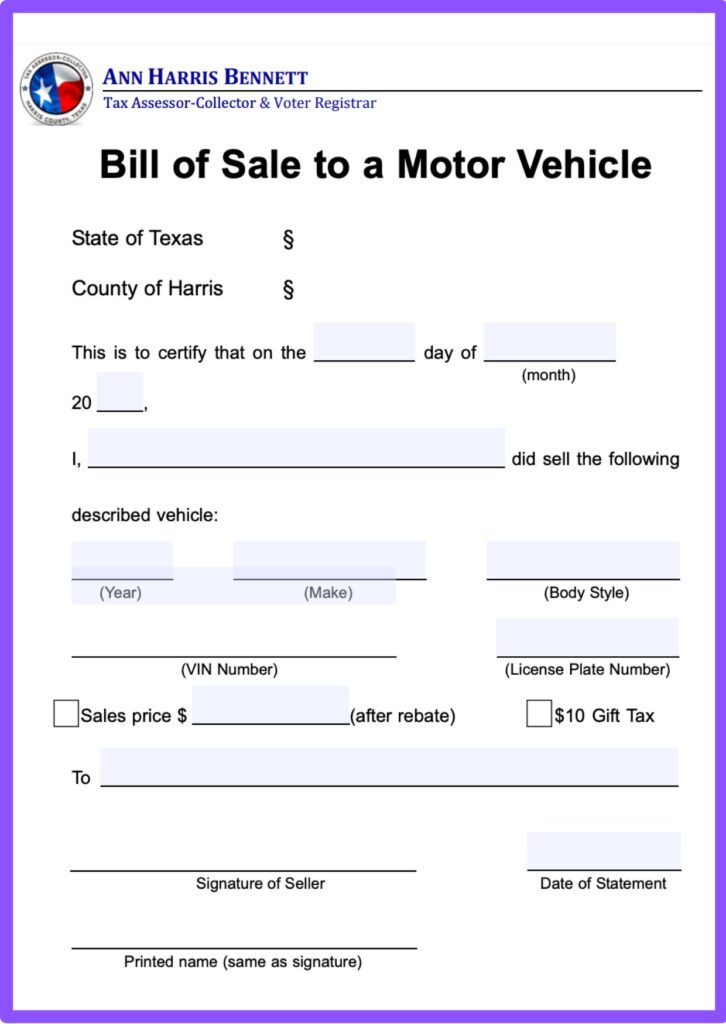

Texas Motor Vehicle Bill of Sale

The Texas Motor Vehicle Bill of Sale is a crucial document for anyone buying or selling a vehicle in the state. This legal form serves as proof of the transaction and protects both parties involved.

Benefits include:

- Legal Protection: Provides a written record of the sale, safeguarding against disputes.

- Clear Transfer of Ownership: Facilitates the proper transfer of the vehicle title.

- Tax Documentation: Can be used for tax purposes and establishing vehicle value.

- Proof of Purchase: Serves as evidence of the purchase date and agreed price.

- Buyer’s Assurance: Ensures that the vehicle has no liens or legal issues.

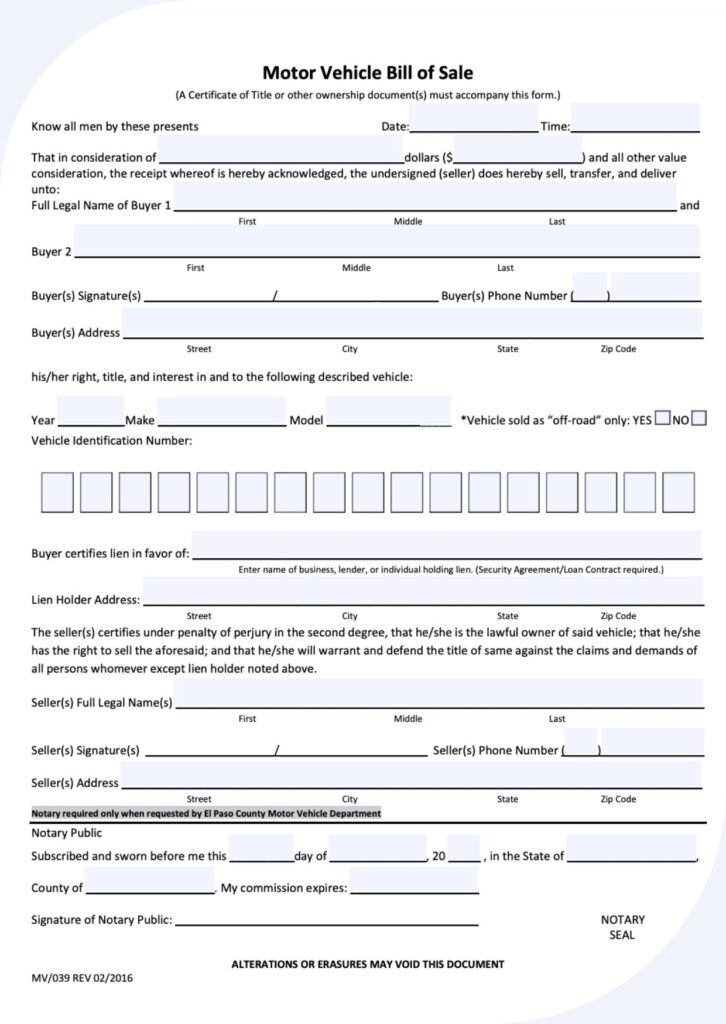

Texas Vehicle Bill of Sale PDF

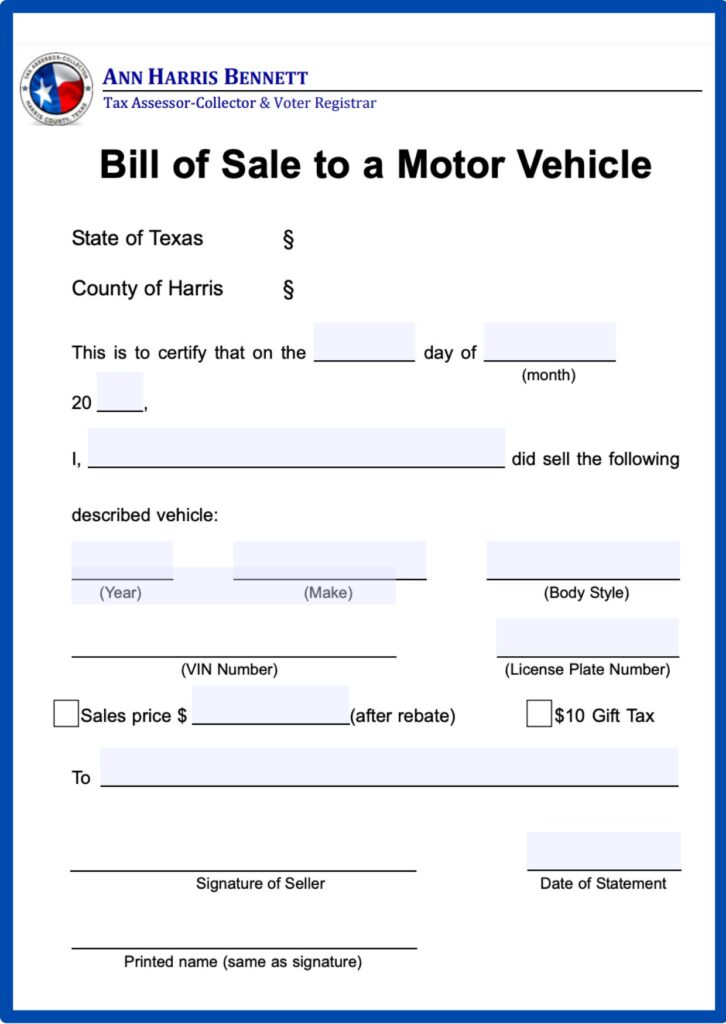

Texas Department of Motor Vehicles Bill of Sale

The Texas Department of Motor Vehicles Bill of Sale is a crucial document for vehicle transactions in Texas, providing legal proof of the sale between a buyer and seller. This document helps protect both parties and ensures a smooth transfer of ownership.

Benefits of a Bill of Sale:

- Legal Protection: Serves as a legally binding contract.

- Proof of Ownership: Confirms the buyer’s ownership of the vehicle.

- Tax Documentation: Helps in determining sales tax liabilities.

- Dispute Resolution: Provides evidence in case of disagreements.

- Vehicle History: Assists in tracking the ownership and history of the vehicle.

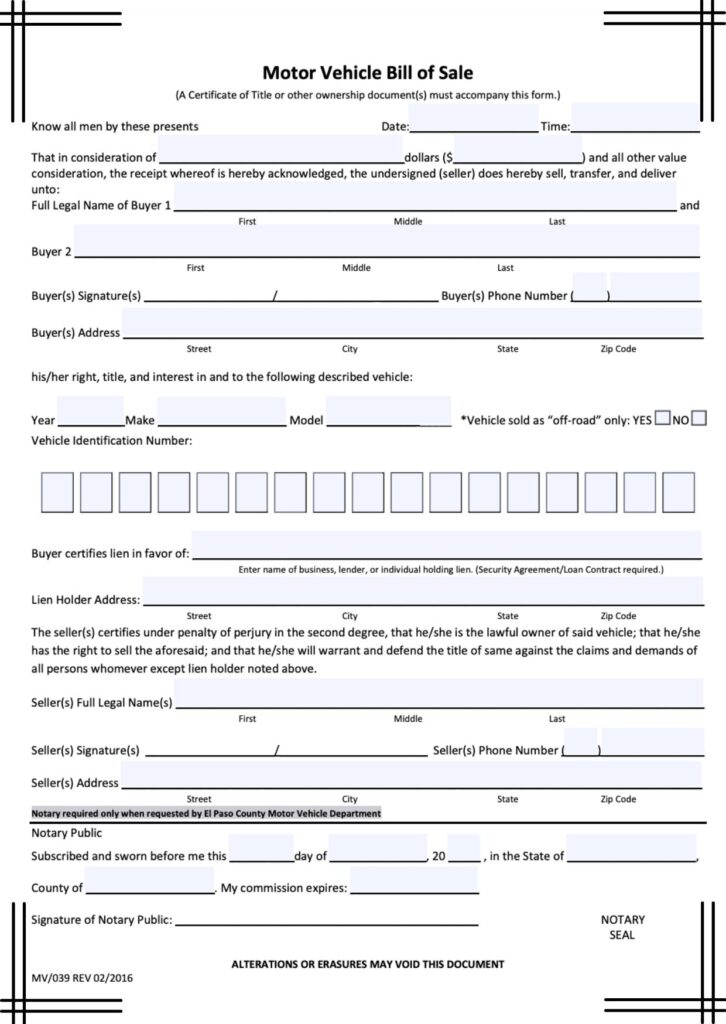

Texas Bill of Sale for Vehicle Form

The Texas Bill of Sale for Vehicle Form is a crucial document for anyone buying or selling a vehicle in Texas. This form serves as a legal record of the transaction, protecting both parties involved. Its benefits include:

- Proof of Ownership: Establishes legal ownership transfer.

- Sales Tax Documentation: Provides necessary information for tax calculations.

- Clear Terms: Outlines the sale conditions, such as price and vehicle condition.

- Fraud Prevention: Helps prevent disputes by documenting the transaction details.

- Ease of Registration: Facilitates the vehicle registration process with the Texas Department of Motor Vehicles.

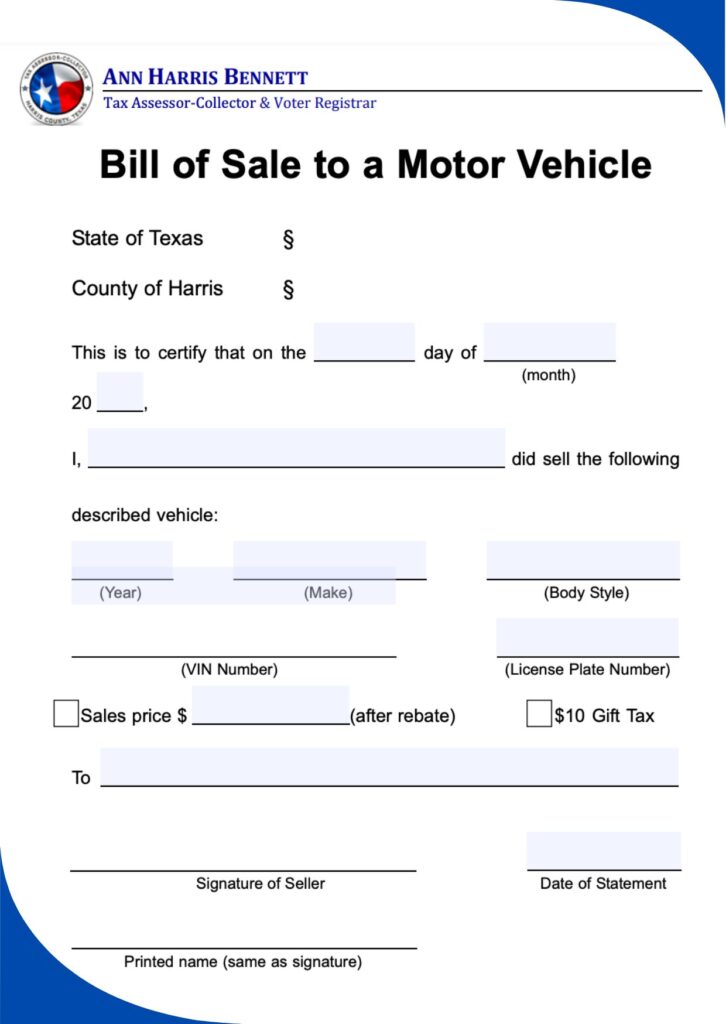

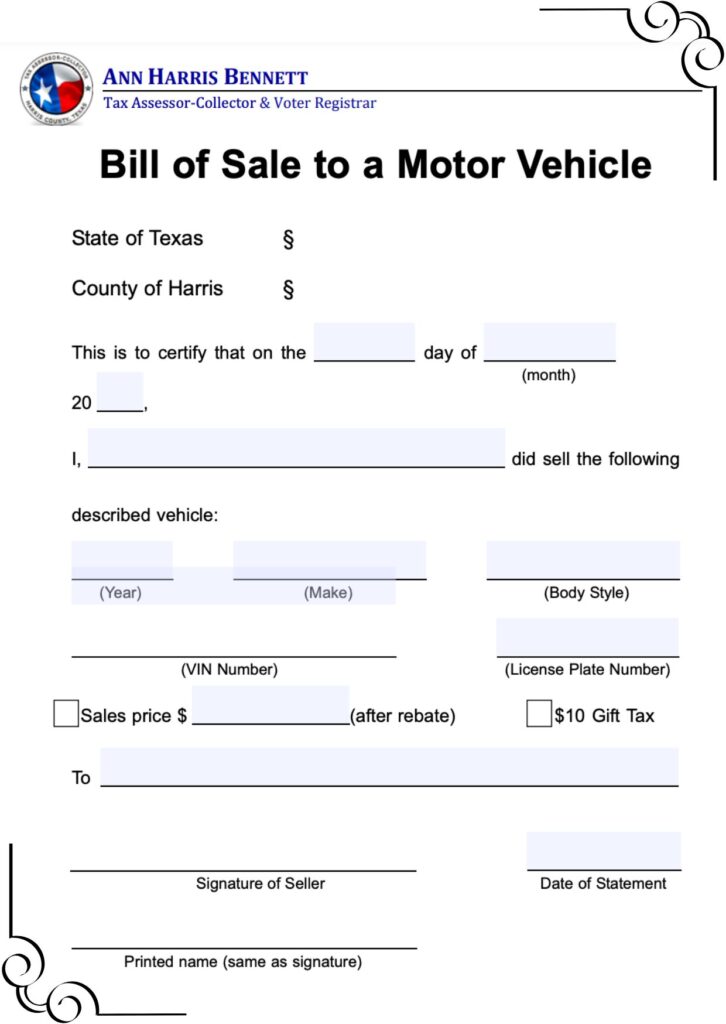

Texas DMV Vehicle Bill of Sale Form

The Texas DMV Vehicle Bill of Sale Form is a crucial document for anyone buying or selling a vehicle in Texas. This form serves as a legal record of the transaction, providing protection for both the buyer and seller. Key benefits of using the Vehicle Bill of Sale include:

- Proof of Ownership: Confirms the transfer of ownership.

- Legal Protection: Offers legal evidence in case of disputes.

- Tax Documentation: Helps in calculating taxes owed on the transaction.

- Vehicle History: Assists in maintaining a clear record of the vehicle’s ownership.

- Customization: Can include specific terms of the sale.

Texas Vehicle Bill of Sale Word Doc

Blank Vehicle Bill of Sale Texas

Sale Information

When completing a vehicle transaction, the Sale Information section of the bill of sale is critical, as it outlines the terms of the sale and provides transparency for both the seller and the buyer. This section ensures that both parties are aware of the financial aspects of the transaction and any conditions attached to the sale, fostering trust and clarity. Below are the key components that should be included in this section:

- Purchase Price of the Vehicle: This is the agreed-upon amount for the vehicle, which should be clearly stated. It is essential to include any applicable taxes or fees in this total, as these can impact the overall cost of the vehicle. Providing a detailed breakdown can help prevent misunderstandings regarding the final sale price.

- Date of Sale and Payment Method: The date on which the sale is completed should be specified, as it marks the official transfer of ownership. Additionally, it’s important to indicate the payment method used for the transaction, whether it be cash, a check, financing, or another form of payment. This information serves as a record of how the transaction was conducted and can be useful for future reference.

- Statement of “As-Is” Sale: If the vehicle is sold “As-Is,” this should be explicitly stated in the bill of sale. An “As-Is” sale indicates that the buyer accepts the vehicle in its current condition, with no warranties or guarantees from the seller regarding its functionality or quality. If there are any warranties or guarantees associated with the vehicle, these should also be detailed in this section to provide clarity on the seller’s obligations.

- Disclosure of Any Liens on the Vehicle: It is crucial for the seller to disclose any existing liens on the vehicle. A lien signifies that a third party, such as a bank or financing company, has a legal claim to the vehicle until the associated debt is paid off. Including this information protects the buyer from potential legal issues and ensures that they are fully informed about the vehicle’s status before completing the purchase.

By thoroughly detailing these elements in the sale information section, both the buyer and seller can feel confident that the transaction is conducted fairly and transparently, reducing the likelihood of disputes in the future.

Odometer Disclosure Statement

The Odometer Disclosure Statement is a vital component of the vehicle bill of sale, as it serves to protect both the buyer and the seller from potential disputes related to the vehicle’s mileage. This statement is legally required in many states, including Texas, to ensure transparency in the sale of used vehicles.

- Required Statement About the Odometer Reading and Certification: The bill of sale must include a clear statement regarding the vehicle’s odometer reading at the time of sale. This information is crucial because it provides an official record of the vehicle’s mileage, helping to establish its value and condition. The seller is typically required to certify that the odometer reading is accurate and truthful at the time of sale, which reinforces the legal validity of the transaction.

- Declaration of Mileage Status: In addition to the odometer reading, the statement should declare the status of the mileage, including:

- Accurate Mileage: If the mileage recorded on the odometer is accurate, the seller should confirm this explicitly.

- Exceeds Mechanical Limits: If the vehicle’s odometer has rolled over and exceeded its mechanical limits (typically 100,000 miles), this should be noted. In such cases, the actual mileage may be unknown or inaccurate, which can impact the vehicle’s valuation.

- Inaccurate Due to Vehicle Repair or Tampering: If the seller is aware that the odometer reading is inaccurate due to repairs, tampering, or any other reasons, this must be disclosed. Providing this information protects the buyer and ensures they are aware of any potential issues with the vehicle’s history.

Including a comprehensive Odometer Disclosure Statement in the bill of sale not only fulfills legal obligations but also fosters trust between the parties involved. By being upfront about the vehicle’s mileage status, both the seller and the buyer can avoid misunderstandings and potential legal complications in the future.

FAQ

What is a Vehicle Bill of Sale in Texas?

A Vehicle Bill of Sale in Texas is a legal document that serves as a record of the transfer of ownership of a vehicle from one party to another. It provides important details about the vehicle being sold, the seller, and the buyer, ensuring that both parties have a clear understanding of the transaction.

Key Features of a Vehicle Bill of Sale in Texas:

- Identification of Parties: The document includes the full legal names and contact information of both the seller and the buyer, establishing their identities in the transaction.

- Vehicle Details: It provides specific information about the vehicle, such as:

- Make, model, and year.

- Vehicle Identification Number (VIN).

- Mileage (odometer reading).

- License plate number.

- Purchase Information: The bill of sale outlines the purchase price of the vehicle, including any applicable taxes or fees. It also specifies the date of sale and the method of payment (e.g., cash, check, financing).

- Odometer Disclosure Statement: This section certifies the accuracy of the odometer reading at the time of sale and discloses any discrepancies, such as rolled-over mileage or tampering.

- Condition of Sale: The document may indicate whether the sale is “As-Is,” meaning the buyer accepts the vehicle in its current condition without any warranties or guarantees from the seller.

- Signatures: Both the seller and buyer must sign the bill of sale, indicating their agreement to the terms outlined in the document.

Importance of a Vehicle Bill of Sale in Texas:

- Legal Protection: The bill of sale serves as proof of the transaction and can be used in case of disputes regarding ownership or vehicle condition.

- Transfer of Title: It is often required for the buyer to register the vehicle and transfer the title with the Texas Department of Motor Vehicles (TxDMV).

- Record Keeping: The bill of sale helps maintain accurate records of vehicle ownership, which can be important for future transactions, insurance claims, or legal matters.

In summary, the Vehicle Bill of Sale in Texas is a vital document that formalizes the sale of a vehicle, providing essential information and protecting the interests of both the seller and the buyer.

What information should be included in a Texas Bill of Sale?

A Texas Bill of Sale should include several key pieces of information to ensure that the document is complete, legally valid, and protects the interests of both the buyer and seller. Here are the essential elements that should be included:

Essential Information for a Texas Bill of Sale

- Date of Sale: The specific date when the transaction takes place.

- Seller Information:

- Full legal name of the seller.

- Address of the seller (including city, state, and ZIP code).

- Contact information (phone number or email address).

- Buyer Information:

- Full legal name of the buyer.

- Address of the buyer (including city, state, and ZIP code).

- Contact information (phone number or email address).

- Vehicle Information:

- Make (e.g., Ford, Toyota).

- Model (e.g., F-150, Camry).

- Year (e.g., 2020).

- Vehicle Identification Number (VIN).

- Odometer reading (current mileage at the time of sale).

- License plate number (if applicable).

- Purchase Price: The total amount agreed upon for the sale of the vehicle, including any applicable taxes or fees.

- Payment Method: A description of how the payment will be made (e.g., cash, check, financing).

- Odometer Disclosure Statement: A statement confirming the accuracy of the odometer reading at the time of sale, including declarations regarding:

- Accurate mileage.

- Exceeded mechanical limits (if applicable).

- Inaccurate due to vehicle repairs or tampering (if applicable).

- Condition of Sale:

- Statement indicating if the sale is “As-Is,” meaning the buyer accepts the vehicle in its current condition without warranties.

- Any warranties or guarantees offered by the seller, if applicable.

- Disclosure of Liens: A declaration of any existing liens on the vehicle, indicating whether the vehicle is free of any legal claims.

- Signatures:

- Signature of the seller.

- Signature of the buyer.

- Date of signatures.

Additional Information (Optional)

- Notary Acknowledgment: Although not required, having the document notarized can provide extra legal protection and validate the signatures.

- Witness Signatures: Including witnesses can also enhance the document’s validity, although this is not typically required.

By including all of these elements, the Texas Bill of Sale will provide a comprehensive record of the transaction, helping to ensure a smooth transfer of ownership and legal protection for both parties involved.

Can I use a template for the Texas Vehicle Bill of Sale?

Yes, you can use a template for the Texas Vehicle Bill of Sale. Using a template can streamline the process of creating the document, ensuring that you include all the necessary information required for a legal and effective transaction. Many templates are available online in various formats, such as PDF or Word, and can be easily customized to fit your specific needs.

When selecting a template, ensure that it contains sections for essential details such as the buyer and seller’s information, vehicle description, purchase price, odometer disclosure, and signatures. A well-structured template will help protect both parties by providing clear documentation of the sale, making it easier to complete the transaction and register the vehicle with the Texas Department of Motor Vehicles (TxDMV).

Do I need to have the Bill of Sale notarized in Texas?

No, you do not need to have the Bill of Sale notarized in Texas for it to be valid. While notarization is not a legal requirement, having the document notarized can provide additional protection and help prevent disputes between the buyer and seller. Notarization verifies the identities of the parties involved and confirms that they signed the document voluntarily.

If either party feels more comfortable with notarization, they can choose to have the Bill of Sale signed in the presence of a notary public. This extra step can enhance the document’s legal validity and serve as an added safeguard in case any issues arise in the future regarding the sale.

Hi, I’m William Bennett, an Automotive Executive based in Houston, Texas. With years of experience in the automotive industry, I created Bill of Sale Texas to offer Texans a straightforward resource for managing bill of sale documents. My goal is to help make the process of buying and selling vehicles in Texas as smooth and informed as possible.

![Bill of Sale Texas For Car, Vehicle [Edit & Printable] PDF](https://billofsaletexas.com/wordpress/wp-content/uploads/2024/11/Bill-of-Sale-texas-1-160x45.png)